How to Recover a Suspended Pinterest Account and Prevent Future Bans?

Pinterest has emerged as a hotbed of creativity and sharing in recent years, attracting a large number of users who …

Table of Contents

In today's digital payment era, Venmo serves as a popular mobile payment application, increasingly favored by users. Whether splitting bills with friends or making small payments, Venmo offers significant convenience. Alongside enjoying this convenience, understanding Venmo's various payment methods and platform limit policies can help you better manage personal finances.

Venmo Debit Card (essentially a prepaid card) directly links to your Venmo account balance, meaning you can only use funds already available in your account for payments, which helps control spending and avoid overdrafts, as you can only spend what you have deposited.

Venmo Credit Card, on the other hand, allows users to make payments using a credit limit, meaning you can spend even when you don't have enough cash on hand, and then pay it back later. This offers greater financial flexibility, but requires responsible credit management.

Venmo Debit Card:

Venmo Credit Card:

Venmo Debit Card:

Venmo Credit Card:

Venmo Debit Card: does not impact your credit score, as it does not involve credit limits

Venmo Credit Card: is linked to your credit score, especially regarding credit utilization and payment history

You can understand the differences between the two through the comparison table below:

| Comparison Metrics | Venmo Debit Card | Venmo Credit Card |

|---|---|---|

| Payment Source | Directly linked to Venmo balance or bank account, using available funds | Uses credit limit provided by the bank, can spend beyond available cash |

| Annual Fees | No annual fees; personal transfers are free; standard transfers are free | 3% transaction fee for credit card payments; potential annual fees and interest |

| Rewards and Cashback | Typically does not offer cashback or rewards | Offers3% cashback; can be used for free transactions or to purchase additional funds |

| Impact on Credit Score | No impact, does not involve credit limits | Has an impact, linked to credit utilization and payment history |

| Instant Transfer Fees | Charges1.5% (minimum $0.25, maximum $15) | Not applicable (credit card cannot be used for instant transfers) |

| Best Use Cases | Everyday personal transfers, budget control, avoid overdrafts | Ideal for larger purchases, cashback opportunities, and credit building |

Understanding the various limits on Venmo is crucial for effective use of the platform. Below are the main types of limits:

Unverified Users: Venmo will impose strict transfer limits on accounts that have not verified their identity.

Verified Users: By providing Venmo with your legal name, address, date of birth, and Social Security Number (SSN) to verify your identity, your account will unlock higher transfer limits.

For users who enjoy adding funds, Venmo has set the following limits:

Standard Transfer: Transfers from Venmo to your bank account typically take 1-3 business days, free of charge

Instant Transfer: Funds are available in 30 minutes, with a fee of 1.5% (minimum $0.25, maximum $15)

For users with larger transaction amounts, Venmo's transfer limits may seem insufficient. You can request to increase your account limits by verifying your identity through official channels, and also maintain multiple Venmo accounts to help resolve limit issues.

If you have different projects or brands that require separate income management, having multiple independent Venmo accounts is often necessary. According to Venmo's User Agreement , each user can only hold one personal account. If you attempt to create multiple Venmo accounts on a single device, it may result in all related accounts being temporarily suspended, affecting business operations.

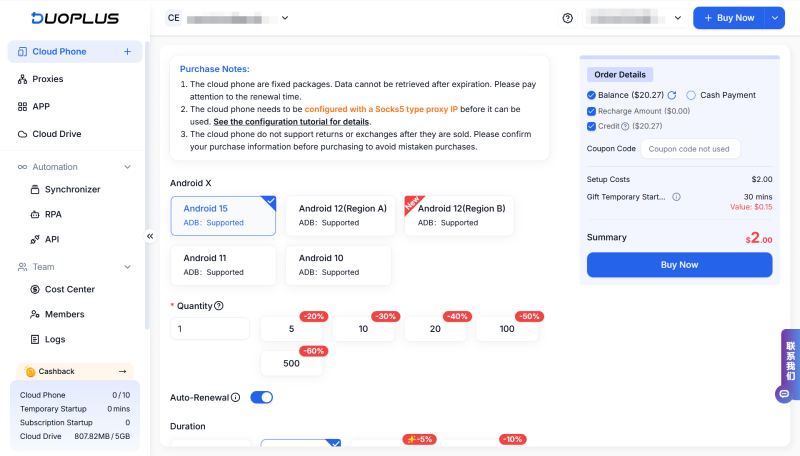

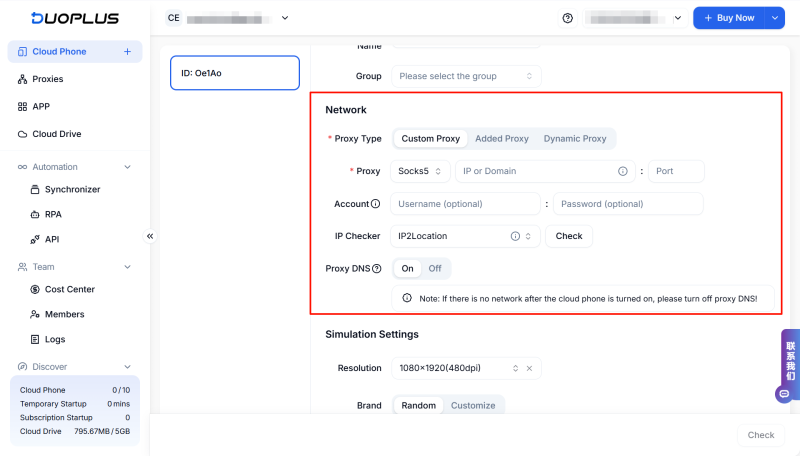

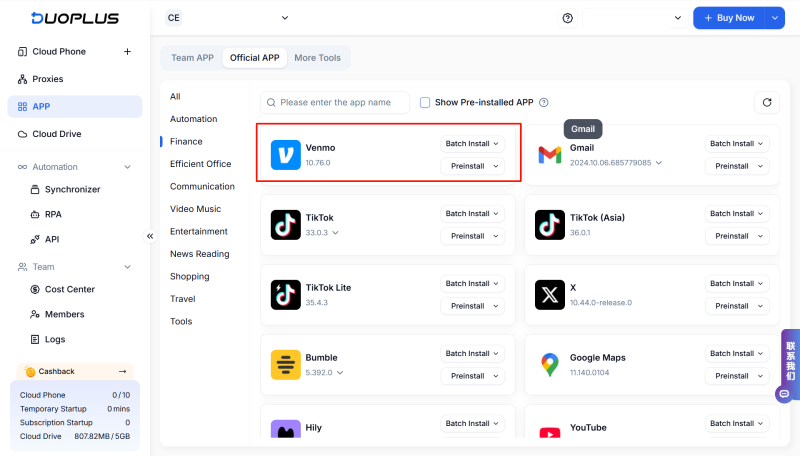

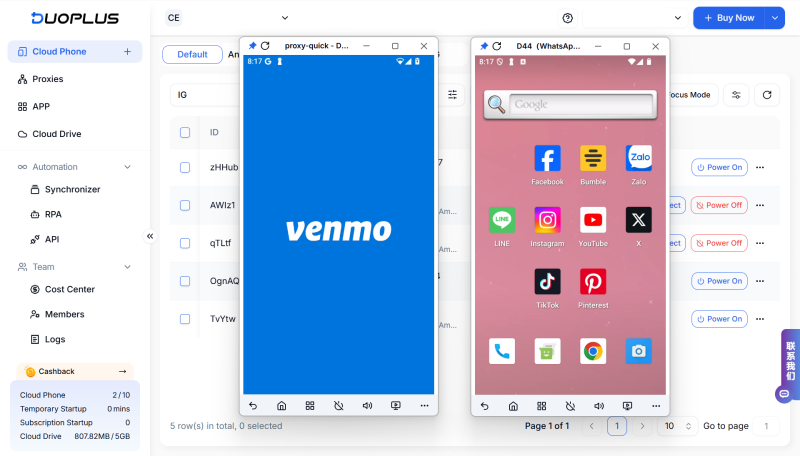

So, is there a safe and effective tool to help you manage multiple Venmo accounts? DuoPlus is your best choice.

DuoPlus can provide each Venmo account with a separate, clean mobile device environment, perfectly solving account-related issues. Based on real ARM architecture, DuoPlus mobile device environment supports different device configurations for each phone, and also supports different proxy IPs for each device, simulating real Venmo users.

Using DuoPlus to Manage Multiple Venmo Accounts

1. Does Venmo support international transfers?

Venmo is currently only available within the United States, and does not support international transfers. If you need to make international payments, you may consider using other platforms that support cross-border payments, such as PayPal or Wise.

2. Is there a fee for using Venmo?

Using Venmo for personal transfers is typically free, provided you use a bank account or Venmo balance for payments. If you use a credit card for payments, Venmo will charge 3% transaction fees. Instant transfers will also incur a 1.5% fee (minimum $0.25, maximum $15).

3. How can I ensure my Venmo account is secure?

To secure your account, enable two-factor authentication, use a strong password, and regularly update your password. Also, avoid sharing account information with others and refrain from conducting transactions over public Wi-Fi networks. Set your transaction settings to private mode, which can enhance privacy protection.

Understanding the distinctions between Venmo debit and credit cards, as well as the various platform limit policies, is crucial for effectively managing your finances. Regardless of which payment method you choose, always ensure you understand Venmo's limit policies and take necessary security measures to protect your account.

DuoPlus Cloud Phone

Protect your multiple accounts from being

Pinterest has emerged as a hotbed of creativity and sharing in recent years, attracting a large number of users who …

Reddit is a highly influential community platform with substantial reach, extensively used in areas such as offshore …

No need to purchase multiple real phones.

With DuoPlus, one person can operate numerous cloud phones and social media accounts from a single computer, driving traffic and boosting sales for you.