What is KYC Verification?

KYC (Know Your Customer) means "understanding your customer" and is a crucial regulatory requirement that ensures financial institutions, encrypted currency trading platforms, and other entities can identify and verify their customers' identities to prevent financial crimes and other illicit activities.

In the encrypted currency sector, the importance of KYC verification is particularly pronounced, as it is essential for maintaining market stability and security. Encrypted currency trading platforms must implement strict KYC verification processes to comply with regulatory requirements and protect users and the platform's benefits.

What Verification Methods are Available for KYC?

Identity Document Verification

- Government-issued identity documents: Users are required to upload or provide valid government-issued identity documents such as ID cards, passports, or driver's licenses.

- Photo verification: Users may need to take a photo of their identity document and upload it to verify its authenticity.

Real-name Verification

- Selfie verification: Users need to take a selfie holding their identity document to prove they are the rightful owner of the document.

- Video verification: Through video calls, staff can verify the user's identity in real-time.

Address Verification

- Address proof documents: Users need to provide documents such as utility bills, bank statements, or rental agreements to verify their residential address. Generally, cross-border trading platforms will require users to upload these documents for KYC verification.

- Electronic statements: Some service platforms also accept electronic versions of address proof documents.

Biometric Verification Techniques

- Fingerprint recognition: Use fingerprint scanning technology to verify the user's identity.

- Facial recognition: Use facial recognition technology to verify the user's identity through a camera.

- Iris scanning: Utilize iris scanning technology for identity verification.

Email and Mobile Verification

- Email verification: Send a verification email to the user's registered email address, requiring the user to click a link in the email to verify their email address.

- Mobile verification: Send a verification code to the user's registered mobile phone, requiring the user to enter the code to complete verification.

Impact of KYC Verification on Encrypted Currency Trading

Identity Verification: KYC verification can ensure the authenticity of the user's identity, making it easier to meet regulatory requirements for trading platforms. It helps prevent fraudulent accounts and suspicious activities.

Trading Supervision: KYC verification can assist trading platforms in better monitoring user trading activities and promptly identifying suspicious activities for intervention.

Risk Assessment: KYC verification can help trading platforms assess the risk levels of users, enabling them to implement appropriate risk management measures.

How Should KYC Verification Be Conducted in Encrypted Currency Trading?

KYC verification is crucial for protecting users and ensuring the security of the platform, but many users often face various challenges during this process, such as document non-compliance, inconsistent information, or prolonged review times. These issues can not only lead to verification failures but also affect the user's trading experience. Therefore, understanding these common challenges and grasping some skills to improve KYC verification success rates is particularly important.

Common Challenges in KYC Verification

- Document Redundancy: Different trading platforms may require different identity documents for verification, often involving multiple steps and document uploads.

- Information Accuracy: During the KYC verification process, users need to ensure that the information provided is accurate and error-free to avoid affecting account usage.

- Regulatory Compliance Issues: Different countries or regions may have varying KYC requirements, and users may encounter compliance issues when using encrypted currency services across borders.

Steps to Improve KYC Review Speed and Success Rate

1. Prepare Required Documents

- Identity Verification Documents: Ensure that valid identity documents are prepared, such as ID cards, passports, or government-issued identity documents. The documents should be clear and readable, and not expired.

- Address Verification Documents: Prepare recent utility bills, bank statements, or other official documents that display your name and address. These documents typically need to be dated within the last few months.

- Selfie: Some platforms may require a selfie with the identity document. Ensure the photo is taken in good lighting and clearly shows your face.

2. Follow Platform Requirements

- Detailed Reading of Guidelines: Each encrypted trading platform may have different KYC requirements, so ensure you read and follow all guidelines provided by the platform.

- Use High-Quality Equipment: Use high-quality cameras to take photos or scan documents, ensuring that all information is clear and visible to avoid blurriness or shadows.

3. Timely Submission

- Quick Response: When required to provide additional information or documents, respond promptly to avoid delays.

- Avoid High Peak Times: Choose to submit your application during off-peak hours to potentially speed up processing times.

4. Ensure Information Consistency

- Consistency Check: Ensure that all provided information (name, address, etc.) is consistent across different documents and accounts to avoid delays due to discrepancies.

- Update Documents: If your address or other information changes, ensure that you update the relevant documents and information on the platform in a timely manner.

5. Understand Platform Review Processes

- Platform Background: Understand the KYC review processes of the trading platform you are using, which can help you better prepare the necessary materials.

- Contact Customer Support: If you encounter issues during the KYC process, you can contact the platform's customer support for specific requirements or processing progress.

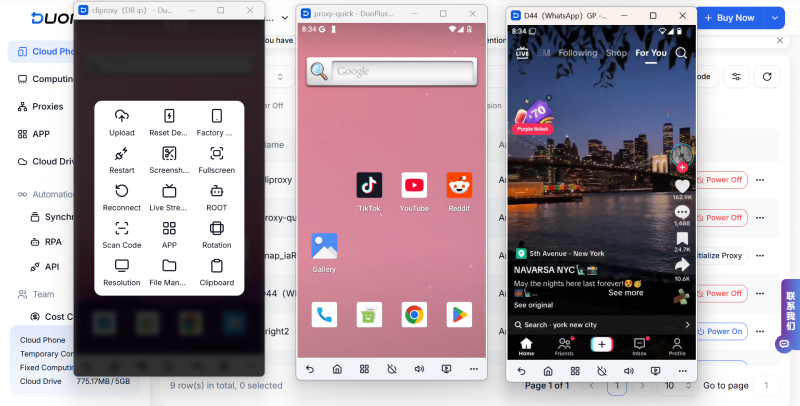

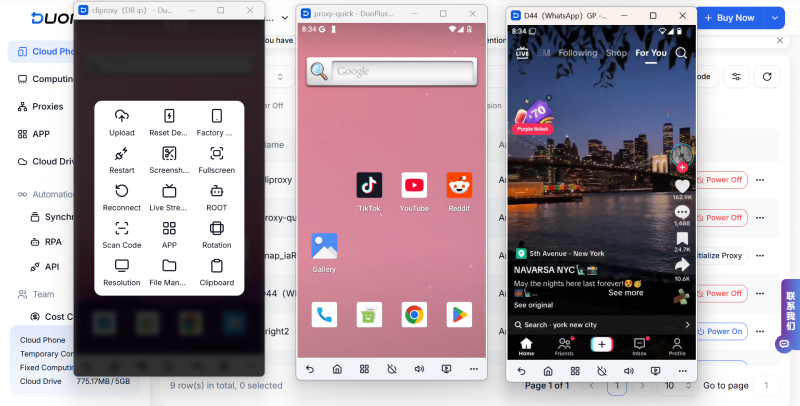

How Does DuoPlus Cloud Phone Help Users Efficiently Pass KYC Verification?

In the context of encrypted currency trading, DuoPlus Cloud Phone can play a crucial role, not only in managing multiple encrypted trading accounts on a unified device but also in assisting with the KYC verification process, ensuring data security and account stability.

How Does the Cloud Phone Simplify the KYC Verification Process?

- One-Click Scanning: Users can use the DuoPlus Cloud Phone to scan their identity documents, completing KYC verification quickly and avoiding cumbersome manual input, thus improving verification efficiency.

- Data Security Protection: DuoPlus Cloud Phone directly stores data in the cloud, generally preventing data from being stored locally, ensuring user data security and avoiding information leakage.

Steps for Users to Efficiently Pass KYC Verification through DuoPlus Cloud Phone

- Register Cloud Phone Account: Users first need to register an account on the DuoPlus Cloud Phone platform.

- Obtain Cloud Phone Device: Users can choose to purchase a DuoPlus Cloud Phone device and complete the basic configuration.

- Create or Log in to Multiple Accounts: Using the cloud phone's unlimited multi-account feature, users can create and manage multiple encrypted currency accounts quickly.

- Utilize Camera Scanning Function to Complete KYC Verification: Use the DuoPlus Cloud Phone's camera scanning function

(using the camera of the login device) to quickly complete KYC verification, simplifying the process while ensuring data security.

Conclusion

KYC verification is crucial for the stability and development of the encrypted currency trading sector. It not only protects the authenticity of account holders but also enhances the compliance of trading activities. DuoPlus Cloud Phone, through its multi-account management and camera scanning capabilities, can effectively simplify the KYC verification process, enhancing user experience and data security, and helping users efficiently pass KYC verification.

nter the link https://www.duoplus.cn/share/ofblog

to register and receive a one-month cloud mobile service,you can it directly! Additionally, you can find【DuoPlus】on Telegram, where you can obtain an exclusive redemption code and gain trial access!

If you have any questions,add the Telegram channel:https://t.me/duoplusen

You May Also Like